The Pharmaceutical Industry, Tariffs and Country of Origin

- amigoldenstein

- Mar 15, 2025

- 3 min read

Updated: Mar 16, 2025

The Trump administration's focus on tariff increases has the pharmaceutical industry grappling with a new reality and concern. Recently implemented tariffs on Mexico, Canada, and China have added to the complexity. As of March 4th, the US has imposed a 25% tariff on imports from Canada and Mexico. Additionally, the US increased tariffs on imports from China by 10%, making it a total of 20% on imports from China.

Although Trump is considering four exemptions to the reciprocal tariffs, including imported cars and pharmaceutical industries, nothing has been concluded yet. As a result, Pfizer's CEO has stated that the drugmaker may move overseas manufacturing to its existing plants in the United States if required, as the Trump administration threatens numerous tariffs on imported goods. Similarly, Eli Lilly's CEO David Ricks announced that the company plans to spend at least $27 billion to build four new manufacturing plants in the United States, as the drugmaker grapples with the threat of drug import duties from the Trump administration.

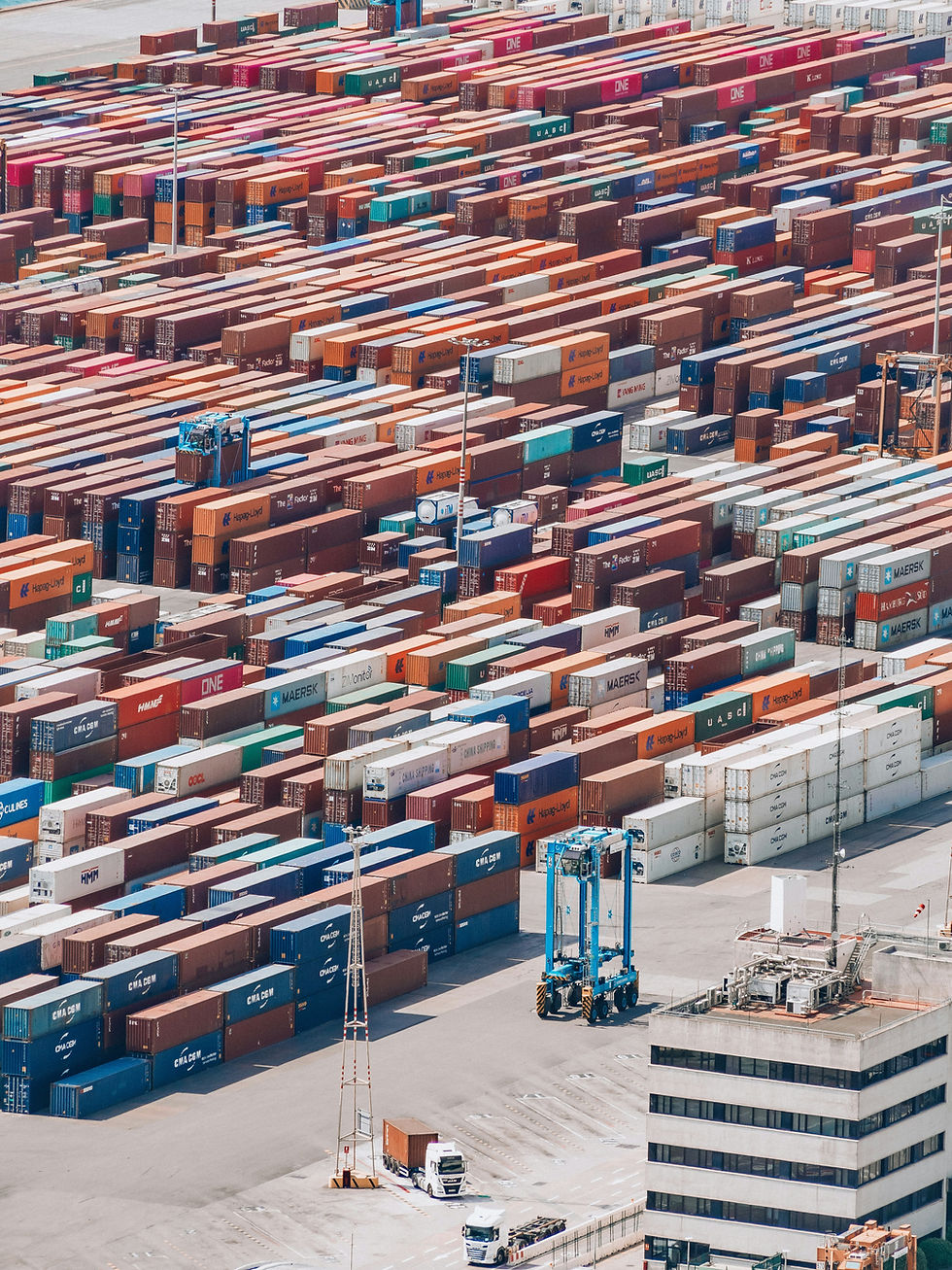

As a result, pharmaceutical companies have started to evaluate supply chains, consider the additional manufacturing costs, and assess the impact on the management and profitability of certain products. Transfer Pricing and supply chain teams are collaborating more closely with trade, compliance, and customs teams to identify ways to mitigate and avoid the additional costs.

Pharmaceutical Supply Flows

Supply chains in the pharmaceutical industry tend to be very complex and vary by market. Depending on whether the product is a small molecule or a large molecule (biologics), the supply flows will also differ. For example, in the small molecules supply chain, the process typically starts with the manufacture of the active pharmaceutical ingredient (API), followed by the process of manufacturing into a final tablet, packaging, storage, and distribution. Biological pharmaceutical products are more complex to manufacture and start from creating a master cell batch (MCB), storage, creating a working cell batch (WCB), then manufacturing the drug product, packaging, and distribution. In all supply flows, there are typically multiple locations or plants executing each function in the flow.

Country of Origin

U.S. Customs and Border Protection (CBP) has consistently ruled that combining chemical ingredients to make a finished pill or tablet does not count as "substantial transformation" if the chemical or medicinal properties of the tablet's Active Pharmaceutical Ingredient (API) remain unchanged. Therefore, according to CBP's long-standing rule, a pharmaceutical product is considered to be from the country where the API was produced, even if the API is processed into a finished tablet in another country. For example, if a product's API was manufactured in China and then transformed into a tablet in the US, it was still considered an import from China, and hence a 20% tariff would apply.

However, the U.S. Court of Appeals (Acetris Health, LLC, v. United States, 2018-2399 (Fed. Cir. 2020) for the Federal Circuit overturned this long-standing method for determining the country of origin of pharmaceutical products under the Trade Agreements Act (TAA) in 2020. The new test established by the Federal Circuit now considers pharmaceutical products to be from the country where they are "manufactured" into their final tablet form. This marks a significant change from the previous rule, which identified the country of origin based on where the active pharmaceutical ingredient (API) was produced.

First Sale Rule

Another aspect that can drastically affect the tariffs on a product is the first sale rule in customs valuations. This rule allows US importers to base valuations on the price paid in the first sale or earlier in a series of transactions, rather than the last sale before the product enters the US. To import goods under the first sale rule, three primary requirements must be met:

The goods must be clearly destined for exportation to the U.S.

There must be two bona fide sales between the parties.

The first sale value must be at arm’s length.

For example, consider a US limited risk distributor that imports a finished good from a related entity that functions as a commercial principal and is located in a jurisdiction subject to a 25% tariff. Since the product is a finished good and the US distributor bears limited risks, the transfer price is high, and potential tariffs could be material. However, let's also assume that the commercial principal purchases the product from a related contract manufacturer, which manufactures both the API and bulk tablets for the US and is located in China. Also, the transfer price from the China CM to the commercial principle is set at total cost plus a routine markup. In that case, the first sale rule could provide substantial tariff savings since a 20% tariff would be applied on a significantly lower value.

Conclusion

As the issue of tariffs continues to evolve and may affect industries that were previously unaffected, it is important to keep the conversations going with customs experts to ensure that the risks of tariffs are identified and properly quantified.

Comments